A new book, "The Customer-Base Audit: The First Step on the Journey to Customer Centricity", explains why customer-centric companies are not leveraging customer data while exploring the inefficiencies of traditional customer segmentations. We discuss the 8 main insights on customer base analytics in a customer-centric environment.

Peter Fader and Michael Ross's new book "The Customer-Base Audit: The First Step on the Journey to Customer Centricity" (2022) combines data science and long-term business strategy so that companies make decisions from a customer-centric perspective. Peter Fader, professor of marketing at the Wharton School, and Michael Ross, chief retail scientist at EDITED, say they wrote the book with the intention of creating a universal tool companies can use to measure the health of their customer base and build customer success strategies (CSS).

According to these two experts in customer centricity, customer base analysis is the foundation for transforming customer data and analytics into better business results. They also express now is the ideal time for companies to start doing this type of analysis. In the wake of Covid-19, every customer-centric company in the world is trying to understand what the post-Covid-19 reality looks like. According to Fader and Ross, if you want to understand the new reality, you must look at it through the lens of the customer.

Below we explore the 8 most relevant insights from the book.

8 Insights on Customer Base Analysis to Become Customer Centric

1. Companies are increasingly interested in the customer

According to the authors, organizations are becoming more and more interested in finding out trends in customer behaviour and what they do; how they differ from one another and how they change over time. In other words, the customer-centric perspective is increasingly present in the business decision-making process.

Companies are now paying close attention to value. Investors and other stakeholders want to know what kind of ROI they are getting from their advertising and marketing strategies, as well as how they can make the most of their customers. Questions such as "Is the customer lifecycle getting longer?", "Are customers buying more frequently?", or "Is the average amount spent by customers increasing?" are becoming more relevant.

2. The importance of customer base analytics to be customer centric

One of the main principles of customer-centric companies is to understand that not all customers are the same. By understanding and leveraging their differences, organizations can do a lot more for their clients and their own performance.

However, this is not something that companies should simply assume. On the contrary, they must convince themselves of it, and there is no better way to do so than by analyzing their customer base.

Businesses grow by attracting and retaining customers. If companies are not aware of what percentage of their growth comes from their existing customer base and how many new customers they need to attract to meet their business objectives, their marketing and sales strategies will probably not be as successful as they should be.

Only those companies that leverage analytics to understand how customers behave will be able to pinpoint what is driving their long-term growth.

Today pretty much all companies analyze their customers, but few carry out a systematic and structured audit to deeply understand how their customers are behaving. To do so, companies need to analyze customer data and their customer base at a deep, granular and rigorous level.

3. The problem with traditional customer segmentation

Companies often address questions such as "how do customers behave, how much money do they spend, do they evolve over time?..."— through customer segmentations based on traditional criteria such as age, gender or place of residence.

This type of segmentations are not only imprecise, but also have an expiration date and fail to address long-term business needs.

Customers are people and people change over time. Therefore, the customer segments established by this type of segmentation stop being relevant and reliable when customer segments change. This is quite problematic if we take into account that observing a customer segment over time is one of the key points to understand its behavior, while being able to really understand its contribution to our business.

4. Customer segmentation vs. cohort-based customer base analysis based on cohorts

Building on the idea introduced in the previous point, companies should begin to complement customer segmentation based on generic criteria with analysis of their customer base based on cohorts.

A "cohort" is a group of customers that were acquired in a given period, whether monthly, quarterly or annually. In other words, cohort analytics are not based on the customer's gender or age, but on their timing.

The strength of cohort segmentation is that the members of the cohort never change. That makes it a type of segmentation that is useful in the long term and that can be analyzed over time.

Customer based analysis is not only irreversible, but also covers the entire customer portfolio, since all customers belong to a cohort. Segmentation based on demographic criteria is rarely able to include all consumers, especially in a social context in which concepts such as gender or age are becoming less and less defining and more vague.

5. The three fundamental analyses for understanding the customer: cohort analysis, customer value distribution and timing between purchases

According to the book's authors, a company that wants to start analyzing its customer base should prioritize three essential types of analysis: cohort analysis, the distribution of customer value and the timing between the first and last purchase.

- Cohort Analysis: It is the first analysis that should be carried out. Without it, the other two are pointless. Cohort analysis breaks down how each year's revenue comes from customers acquired in previous periods, providing a very clear picture of the extent to which a company's growth is being driven by its existing customers versus new customers.

- Distribution of customer value: The analysis of the distribution of customer value is crucial for companies to know which customers are providing them with greater value and how many customers are in each segment based on value contribution. In other words, it is a key analysis to have a clear vision of which customers to prioritize or what decisions and actions we should take to obtain greater value from our customers.

- Time between first and second purchase: Understanding the time between the first and second purchase is incredibly useful to understand why customers only buy once and what actions we can take to keep them coming back or to boost customer retention.

6. Companies need to look beyond their best-selling products or services

The analysis of the customer portfolio also covers sales and the company's products or services. However, sales analysis should also be carried out from a customer-centric approach.

Instead of asking ourselves which of our products are best sellers, we should start asking ourselves which products disproportionately attract the customers who have been with us the longest and buy most often. This will help us to better target our marketing and sales resources.

7. CEOs should start thinking about customer analytics

Customer analytics are usually in the hands of the Chief Marketing Officer or CMO. However, the impact of this type of analysis goes beyond marketing.

Customer portfolio analysis is an opportunity to improve profitability; align channels, services and operational experience; and better understand which elements of products or categories are best for attracting and retaining customers. For this to be possible, CEOs need to become part of the conversation.

The problem is that CEOs often have very busy schedules. Therefore, it is paramount that customer analytics is incorporated into the regular cadence of the organization. This way, the CEO can better understand the impact that customer portfolio analysis has on business performance, beyond marketing, and help improve profitability.

Today, understanding profitability is critical. Acquiring and keeping customers regardless of their cost is not a sustainable long-term strategy. Therefore, it is necessary to understand how to build a sustainable growth plan through the acquisition and retention of profitable customers.

In this sense, individual customer profitability should be a unit of analysis that impacts every company.

8. The good news is that you can analyze your customer portfolio in a few seconds

Evidentemente, realizar un análisis de la cartera de clientes suficientemente profundo como para que proporcione los insights que necesita una empresa para comprender el comportamiento de sus clientes, no es una tarea sencilla y requiere de expertos.

Clearly, conducting an analysis of the customer portfolio deep enough to provide the insights a company needs to understand the behavior of its customers is not an easy task and requires experts.

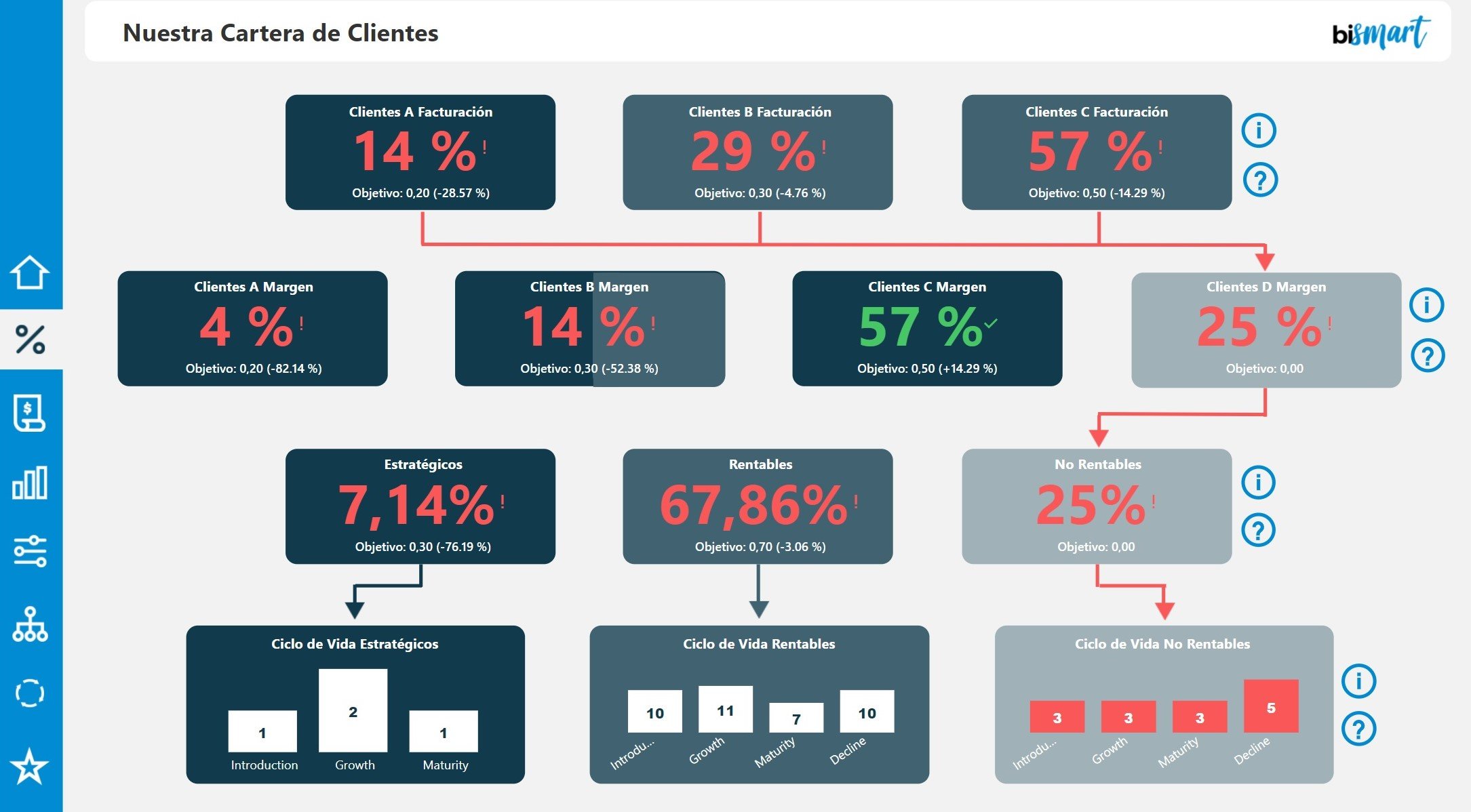

However, there is a solution, ABC Client Analysis, that automates the process. It is an analytical dashboard environment that analyzes and segments the customer base according to criteria of contribution to revenue and profitability.

Customers are divided into cohorts based on two criteria: turnover and gross margin.

With regard to turnover, customers are classified into three categories: A, B and C according to their contribution to the company's turnover. This information is particularly useful for prioritizing sales and marketing efforts towards those customers who contribute the most value.

On the other hand, the gross margin segmentation divides customers into four categories: A, B, C and D according to each customer's contribution to the organization's total gross margin. Category D refers to customers with a negative gross margin, i.e. those that are unprofitable and generate losses.

- Analyzes and segments your customer portfolio based on criteria of contribution to revenue and profitability.

- Classifies customers according to their contribution to gross margin and total revenue.

- Provides financial managers with valuable information to make investment or expense redistribution decisions.

- Provides sales and commercial departments with valuable information for redefining and optimizing commercial strategies.

- Automatically identifies which customers are profitable and which are causing loss.

- Provides insight into the concentration and diversification of your customer base.

- Automatically detects high-risk customers, strategic customers and target customers.

With ABC Client Analysis, performing an in-depth analysis of the customer base is nearly automatic. Since it is a solution that incorporates advanced analytics, it avoids errors and inaccuracies and promotes the implementation of more effective commercial and financial strategies.