Many studies suggest that building customer loyalty is much more cost-effective than acquiring new customers. Not only is it cheaper, but it is also more profitable in the long term. Because of this, more andmore companies are relying on strategies that focus on expanding their customers' lifetime value (LTV), rather than focusing on acquiring new customers.

There are many reports that have been announcing for years that, in marketing and sales, retaining existing customers is far more productive than focusing our business efforts on acquiring new customers. Acquiring new customers has a higher cost —Customer Acquisition Cost (CAC)— than driving customer loyalty or retention strategies. Various researches point out that acquiring a new client costs 5 times more than retaining a customer.

Besides involving a lower initial investment, building customer loyalty always ends up being more profitable than acquiring new customers. Loyal customers are more likely to buy and, most importantly, have a significantly higher customer lifetime value than new clients. A research by Bain & Company found that businesses with hight customer loyalty rates grow 2.5 times more than their competitors. Likewise, research by Small Business Trends concludes that increasing customer retention by 5% can increase profits by 25-95%. Invesp also notes that the success rate of selling to an existing customer is 60-70%, while that of selling to a new customer is 5-20%.

For all these reasons, customers' lifetime value (LTV) is a metric that organisations are paying more and more attention to. But what is lifetime value and how do we calculate it?

What is Lifetime Value (LTV)?

Lifetime Value (LTV) —also called customer lifetime value (CLV or CLTV)— is a concept used in the business world, mainly in marketing, to refer to the estimated benefit a customer will bring our company during the time they are our customer. Thus, lifetime value has to do with the average customer spend and with the time we predict they will be our customers or, in other words, their loyalty rate.

In short, the lifetime value (LTV) is the amount of money we predict a customer will bring us throughout their relationship with our company. In this sense, when marketing strategies talk about improving the LTV, the goal is to increase the amount of time a customer brings us value (i.e., the period during which they will spend money with our organisation.

Therefore improving the LTV involves extending the amount of time a customer spends money in our company.

Why is the lifetime value (LTV) important?

Lifetime value or LTV is extremely important, as it has an impact on the business decision-making process. Among other things, it guides managers in deciding how much to invest in customer acquisition and how much to invest in customer retention or in loyalty-related activities such as optimising the customer experience, customer engagement, creating special offers for returning customers, etc. Clearly, if acquiring a client costs more than the total amount of money we predict this customer will bring us, investing time and money in acquiring them is not worth it and could even lead to losses.

The goal of any organisation is obviously to have a high LTV, which ultimately translates int o marketing and sales strategies that focus on customer loyalty and building relatiomonships that are not only longer but also more meaningful. However, if a company fails to increase its LTV or has a low LTV overall, the firm may decide to spend less money on customer loyalty and invest more in customer acquisition techniques.

LTV also helps organisations identify which customers are profitable and which are not. For example, if a customer has a LTV of €20,000 (over 10 years), but it costs €8,000 per year to retain them, it is probably not worth investing money and effort in them.

How to calculate the Lifetime Value (LTV)?

As we have already mentioned, apart from being a concept, lifetime value usually comes in the form of a performance indicator and, therefore, a measurable metric. Depending on the sector and the characteristics of each company, the LTV may even be a key performance indicator or KPI.

There are different ways of calculating our customers' LTV. Depending on the type of business and the particularities of each company and its customers, some values will be more important than others. Therefore, we will now show two different ways of calculating the LTV: the simpler way and a more sophisticated one.

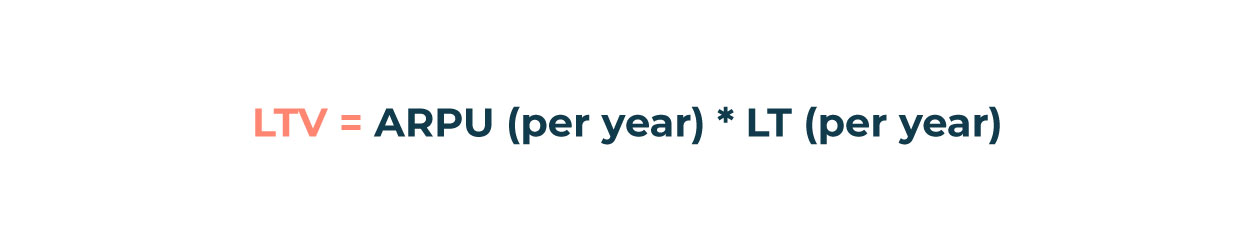

The easiest way to calculate LTV is to multiply ARPU by the average customer lifetime (LT). ARPU (Average Revenue Per User) is nothing more than the average revenue per user or customer and is obtained by dividing the total revenue earned per user by the number of users or customers. In order to make the calculation, we must establish the ARPU over a given period of time. In this case, we have based the example on the annual ARPU.

Our customers' lifetime or estimated lifetime is obtained by calculating the average period of time our customers last.

We will now look at another way of calculating LTV, which is somewhat more complex and is particularly interesting for subscription businesses, as it gives a more comprehensive view of the real profit that customers bring us.

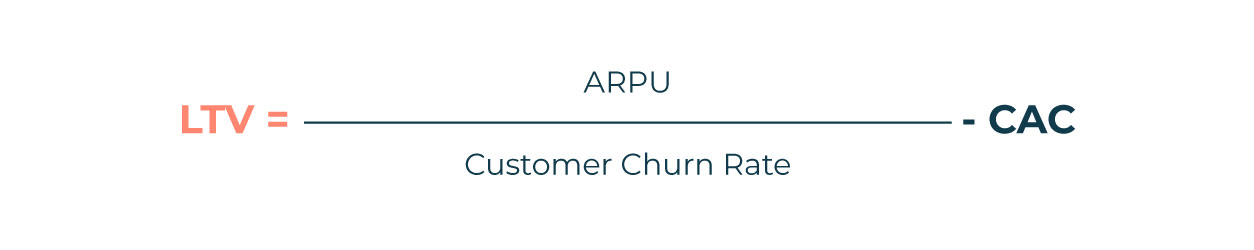

To calculate LTV according to this formula, we must first introduce two other concepts: Churn Rate and CAC.

The Churn Rate is a metric that calculates the percentage of consumers who will stop being our customers in a given period of time. We can, for example, calculate what percentage of users we lose every year or every month.

On the other hand, the CAC (Customer Acquisition Cost) is the average cost of acquiring a new customer.

Once we know the Churn Rate and the CAC, to calculate the lifetime value we will apply this formula:

This second way of calculating the LTV is especially useful when we want to find out the real profit our customers bring us, since we are taking into account the investment we need to acquire a new customer (CAC) and the percentage of customers we lose in a given period of time (Churn Rate).

If we want to be even more exhaustive, we can apply the second formula considering the real value of money in the period of time we are analysing, looking at the prices set and the inflation during that time.

Of course, both formulas are correct and there are even more alternatives for calculating the lifetime value. The important thing is to always consider our business' logic and to be clear about the most important factors when acquiring and retaining customers according to our business model.

How to improve the Lifetime Value (LTV)?

Paying attention to the customer lifetime value and driving actions to improve the lifetime value is more profitable than focusing our efforts on acquiring new customers.

As we have already mentioned, the most effective way to improve the LTV is by implementing customer retention and customer loyalty strategies, which normally translate into segmentation models for the creation of personalised experiences and the optimisation of the customer experience. On the other hand, CLV can be increased by raising the average spend of each of our customers with commercial strategies such as cross-selling and up-selling.

At Kale we are experts in developing solutions focused on deep knowledge about customers to improve companies' value and commercial proposal. We apply analytical models to transform the customer experience towards increasing engagement and we carry out complete action plans for customer loyalty and retention.

Do you want to improve your LTV?