Explore 10 major insights on the 2024-2025 hotel industry outlook, from market growth to investment trends, across different continents.

The hotel industry is going through a stage of transformation and expansion, mainly driven by technological advancements, changing consumer preferences, and a strong recovery from the COVID-19 pandemic.

It is safe to say that 2024 is the first year in which the hotel industry will finally fully recover from the major downfall experienced during COVID-19 years. Recent researches point to a significant growth in tourism, the number of travels, revenue and occupancy rates for 2024 and 2025.

In this context, hotel companies are taking advantage of the good context to finally start exploiting the power of their data and investing in technological advances to improve their efficiency, their revenue and to better adapt to new consumer behaviors.

In this blog post we will explore 10 key insights about the hotel industry in 2024 and 2025, comparing by continent. If you want to dive into a more comprehensive analysis, you can download the full report "Global Hotel Industry Trends and Statistics for 2024-2025: A Continental Comparison" below.

Hotel Industry Insights by Continents

Discover the trends that will shape the international hotel industry in the coming years.

10 Insights about the Hotel Industry in 2024 - 2025

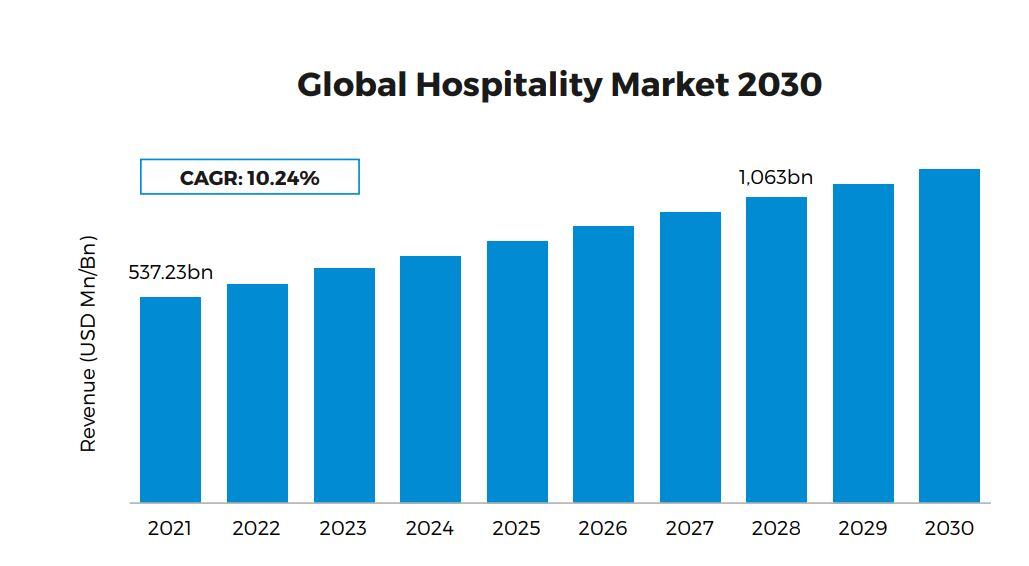

1. The Billion-Dollar Boom: Market Size and Growth

The global hospitality market is expected to reach approximately USD 1,063 billion by 2028, growing at a CAGR (compound annual growth rate) of 10.24% from 2022 to 2028. According to latest stats, this growth is and will continue to be driven by an increase in travel demand and growing rising disposable incomes.

Regional Analysis: Hotel Industry Market Size and Growth by Continent

- USA: The North American hotel market is projected to reach $650 billion in 2024, driven by strong demand in major urban centers such as New York and Los Angeles, and increased domestic and international travel. In comparison, the market was valued at $600 billion in 2023, reflecting a significant growth trajectory bolstered by economic recovery and technological advancements.

- Europe: Europe remains a significant player in the global hotel industry, with an estimated market size of $900 billion in 2024. This growth is supported by high tourist arrivals in countries like France, Spain, and Italy, and major events such as the Paris Olympics. In 2023, the market size was $850 billion, showcasing the region's consistent appeal and rich cultural heritage.

- Asia-Pacific: The Asia-Pacific region is projected to reach a market size of $800 billion in 2024, reflecting robust growth driven by increased travel in China, Japan, and Southeast Asia. The region continues to benefit from rising disposable incomes and expanding tourism infrastructure. In 2023, the market was valued at $750 billion, highlighting the dynamic and rapidly evolving hospitality sector.

- Middle East and Africa: This region is expected to achieve a market size of $350 billion in 2024, driven by significant investments in luxury and experiential travel markets, particularly in the UAE and Saudi Arabia. The growing focus on tourism as a key economic driver is also contributing to this growth. In 2023, the market grew to $320 billion, indicating a steady increase in investments and development.

- Latin America: The hotel market in Latin America is projected to grow to $290 billion in 2024, with Brazil and Mexico leading the way. Despite economic challenges, the region shows potential due to its diverse tourism offerings and increasing international arrivals. In 2023, the market size was $270 billion, demonstrating a promising upward trend driven by strategic tourism initiatives and improving economic conditions.

2. Asia Pacific Leads Hotel Market Growth

While every continent is expected to experience significant growth in the next few years, Asia-Pacific is expected to be at the front of hotel market growth, with China as a market leader.

- North America: The region is expected to grow at a compound annual growth rate (CAGR) of 6% in 2024, driven by robust demand recovery and investment in hotel infrastructure.

- Europe: The European hotel market is projected to grow at a CAGR of 5.8%, supported by strong tourist inflows and major international events.

- Asia-Pacific: With a CAGR of 7.5%, the Asia-Pacific region is set to be one of the fastest-growing markets, driven by increasing tourism from China and other emerging economies in the region.

- Middle East and Africa: The growth rate for this region is projected at 6.2%, reflecting significant investments in tourism infrastructure and luxury markets.

- Latin America: The hotel market in Latin America is expected to grow at a CAGR of 5.5%, with growth opportunities in leisure and resort markets.

3. Revenue Rebound: 2024 RevPAR Surpasses 2019 Levels

Global revenue per available room (RevPAR) is projected to rise by 3% in 2024, thanks to the recovery of group trips, inbound international travel, and traditional short-term business trips.

Forecasts predict that RevPAR in 2024 will be about 13.2% higher than in 2019, highlighting continued positive growth in the industry.

Regional Analysis: RevPAR by Continent

- North America: RevPAR in North America has shown significant recovery, with levels reaching 94%-121% of 2019 figures across various regions. This recovery is primarily driven by strong demand in urban markets such as New York and Los Angeles, along with increased domestic and international travel. The trend is expected to continue into 2024, with urban hotels projected to generate substantial investor interest.

- Europe: Europe continues to experience robust RevPAR growth, particularly in Southern Europe, with some cities exceeding pre-pandemic levels by over 10%. Markets like Paris, Rome, and Barcelona have seen more than 25% growth in RevPAR compared to 2022, driven by high tourist demand and major events such as the Paris Olympics. This positive trend is expected to persist into 2024.

- Asia-Pacific: RevPAR in the Asia-Pacific region is on an upward trajectory, with expectations to surpass 2019 levels by early 2024. The region has seen positive performance trends, especially in resort and leisure-heavy markets. However, the full recovery of outbound Chinese travel is anticipated to extend into 2025, which will further bolster RevPAR across the region.

- Middle East and Africa: High RevPAR in the Middle East and Africa continues to be driven by luxury and resort segments. Cities like Dubai and Riyadh are leading this growth, benefiting from international tourism and large-scale events. The region's overall RevPAR has already surpassed 2019 levels by up to 121%, with continued growth expected in 2024.

- Latin America: Latin America presents a mixed picture, with strong RevPAR growth in leisure destinations such as Buenos Aires and São Paulo. Despite economic challenges in some countries, the region shows significant potential due to robust domestic and regional demand. Markets like Lima, Santiago, and Bogotá have also experienced moderate increases in RevPAR, driven by international travel and local currency devaluations.

4. Occupancy Rates Nearly Reaching Pre-Pandemic Levels

In 2024, global hotel occupancy rates are expected to continue growing, with the global occupancy rate projected to range between 68% and 70%, nearly reaching pre-pandemic levels by the end of the year. This steady growth will be driven by the ongoing recovery of international travel and group trips, along with sustained demand for leisure travel.

Regional Analysis: Occupancy Rates by Continent

- North America: In 2024, the average occupancy rate in North America is anticipated to reach 67.5%, up from 65.3% in 2023. This increase is largely attributed to a resurgence in group business and leisure travel, with particularly strong performance in urban areas.

- Europe: Europe is expected to achieve an average occupancy rate of 65% in 2024. Southern European countries like Spain and Italy are experiencing robust growth, driven by high tourist demand and major events.

- Asia-Pacific: The Asia-Pacific region is projected to have an average occupancy rate of 63.2% in 2024. Further improvements are anticipated as travel restrictions ease and outbound travel from China picks up more fully by 2025.

- Middle East and Africa: Occupancy rates in the Middle East and Africa are expected to average 60.5% in 2024. This growth is driven by strong demand in high-end and luxury market segments, with key markets such as Dubai and Riyadh leading the way.

- Latin America: Latin America's average occupancy rate is projected to be 55.3% in 2024. Higher rates are expected in destinations preferred by tourists such as Mexico City (Mexico), Rio de Janeiro (Brazil) or Cartagena (Colombia).

Hotel Industry Insights by Continents

Discover the trends that will shape the international hotel industry in the coming years.

5. Average Daily Rates Are Also Climbing Higher

In 2024, the global Average Daily Rate (ADR) in the hotel industry is projected to continue growing worldwide, reflecting a strong recovery and growing demand across all regions. The ADR is expected to increase by approximately 4% globally, driven by higher travel demand and increased willingness of travelers to spend on accommodations.

Regional Analysis: ADR by Continent

- North America: In 2024, the Average Daily Rate (ADR) in North America is projected to be around $155. Urban markets like New York and Los Angeles are expected to command higher rates due to strong demand recovery and robust performance in the luxury segment.

- Europe: Europe's ADR is anticipated to reach approximately $150 (132 euros) in 2024. Cities such as Paris, Rome, and Barcelona are experiencing significant increases, driven by high tourist demand and major international events like the Paris Olympics.

- Asia-Pacific: The Asia-Pacific region is expected to have an ADR of about $140 in 2024. Higher rates are being driven by resort destinations and major urban markets, with further improvements anticipated as travel restrictions ease and outbound Chinese travel resumes.

- Middle East and Africa: The ADR in the Middle East and Africa is forecasted to be around $190 in 2024. This reflects strong demand in high-end and luxury markets, with cities like Dubai and Riyadh leading the growth, supported by significant international tourism and large-scale events.

- Latin America: In Latin America, the ADR is expected to reach approximately $130 in 2024. The region shows significant growth potential, particularly in leisure destinations such as Buenos Aires and São Paulo, driven by increasing international arrivals and stable local demand.

6. International Travel Rebounds All Over The World

The UN World Tourism Organization (UNWTO) predicts that international tourism will fully recover to pre-pandemic levels by the end of 2024.

On the same path is GlobalData, which projects that international departures will reach 97% of pre-COVID-19 levels by 2024 and fully recover by 2025, surpassing pre-pandemic numbers with an estimated 1.5 billion international departures.

Regional Analysis: International Tourist Arrivals by Continent

- North America: In 2024, North America is expected to see approximately 210 million international tourist arrivals, driven by the USA and Canada, reflecting a 5% increase from 2023.

- Europe: Europe continues to lead with an estimated 540 million international tourist arrivals in 2024, thanks to high tourism in countries like France, Spain, and Italy, representing a 3% increase from 2023.

- Asia-Pacific: The region is projected to welcome around 320 million international tourists in 2024, with significant contributions from China, Japan, and Thailand, marking a 7% growth from the previous year.

- Middle East and Africa: About 110 million international tourist arrivals are expected, driven by destinations like Dubai and South Africa, reflecting a 10% increase compared to 2023.

- Latin America: The region is expected to see around 90 million international tourist arrivals in 2024, with major contributors being Mexico and Brazil, showing a 12.5% increase from the previous year.

7. Higher Investment: Seizing Hotel Growth Opportunities

In 2024, the debt markets are gaining significant attention as core inflation shows signs of decreasing, which may prompt a shift towards monetary easing following a period of rising interest rates.

Anticipations are high that the Federal Reserve, European Central Bank, and Bank of England will lower rates, bringing clarity to investors and potentially boosting hotel transaction activities.

According to real estate firm JLL, global hotel investment volumes are expected to rise by 15% to 25% in 2024 compared to 2023. This increase is attributed to strong market fundamentals, upcoming loan maturities, and revitalized property improvement initiatives.

Regional Analysis: Investment Trends by Continent

- North America: Investments in urban markets across North America are on the rise, driven by a focus on integrating advanced technology and promoting sustainability. The region is witnessing significant efforts to enhance operational efficiency through technological innovations. These advancements are not only aimed at streamlining operations but also at adopting sustainable practices to appeal to environmentally-conscious travelers.

- Europe: Investor interest remains robust in major European cities, with a particular focus on hotels boasting strong sustainability credentials. Despite a dip in transaction volumes due to high interest rates, there is optimism that the market will rebound as economic conditions stabilize. Investors are keen on properties that demonstrate strong Environmental, Social, and Governance (ESG) credentials, which are becoming increasingly important in the investment decision-making process.

- Asia-Pacific: The Asia-Pacific region is experiencing a surge in investments, especially in urban and resort markets. There is a pronounced focus on leveraging technological advancements and enhancing personalized guest experiences. The region is rapidly adopting smart hotel technologies and AI-driven guest services, aiming to provide a cutting-edge, customized experience for travelers.

- Middle East and Africa: In the Middle East and Africa, we will see a high level of investment in luxury and experiential travel. Significant opportunities exist in resort developments, with the region attracting substantial investments in high-end luxury resorts and unique travel experiences. This growth is fueled by a steady increase in international tourist arrivals, making the region a hotspot for luxury travel investments.

- Latin America: While the investment climate in Latin America remains challenging due to economic instability, there are emerging opportunities in secondary cities and leisure markets. Investors are cautiously optimistic, seeking out markets with high growth potential despite the prevailing economic challenges. The focus is on identifying promising opportunities in areas that show signs of strong future growth.

8. Sustainable Tourism Gains Momentum

Sustainability continues to be a major trend in the hotel industry, with increasing demand for eco-friendly accommodations and practices. Hotels are adopting green certifications, energy-efficient technologies, and waste reduction initiatives to appeal to environmentally conscious travelers.

Regional Analysis: Sustainable Tourism by Continent

- North America: The North American hotel market is seeing a significant shift towards sustainability, with many hotels investing in LEED certifications and renewable energy sources. Cities like San Francisco and Vancouver are leading the way with strong eco-friendly initiatives.

- Europe: Europe remains at the forefront of sustainable tourism, with many hotels adopting strict environmental standards. Scandinavian countries, in particular, are pioneers in eco-friendly hospitality, with widespread adoption of green building practices and sustainable operations.

- Asia-Pacific: The Asia-Pacific region is rapidly embracing sustainable tourism, driven by growing environmental awareness and government policies. Countries like Japan and Australia are focusing on eco-certifications and promoting sustainable tourism practices to attract green travelers.

- Middle East and Africa: The Middle East and Africa are also experiencing increased investments in sustainable luxury resorts, particularly in the UAE and South Africa. These regions are focusing on sustainable construction practices and eco-friendly guest experiences.

- Latin America: Latin American hotels are increasingly embracing sustainable practices as well, prioritizing the preservation of natural resources and the support of local communities. Costa Rica and Brazil stand out for their strong commitment to eco-tourism and sustainability. These countries are leading the way in implementing eco-friendly initiatives and promoting responsible tourism that benefits both the environment and the local population.

9. Technology Transformation in Hospitality

The hotel industry is experiencing a major technological transformation, significantly improving both guest experiences and operational efficiency. Advanced technologies such as artificial intelligence (AI), the Internet of Things (IoT), and contactless services are now essential components of modern hotel operations.

These innovations are helping hotels provide a more seamless, personalized experience for guests while streamlining their internal processes.

Regional Analysis: Technology Adoption by Continent

- North America: Hotels in North America are at the forefront of adopting advanced technologies, particularly focusing on AI-driven personalization and IoT devices for smart room controls. Major cities such as New York and Los Angeles are leading the way in integrating these cutting-edge technologies to elevate guest experiences.

- Europe: In Europe, hotels are increasingly taking advantadge of technology to enhance operations and guest services. Features like smart hotel rooms, mobile check-ins, and AI-powered concierge services are becoming standard in prominent cities like London, Paris, and Berlin, significantly improving the overall guest experience.

- Asia-Pacific: The hospitality sector in the Asia-Pacific region is rapidly advancing technologically. Countries such as China and Japan are leading this charge, utilizing robotics for guest services and implementing IoT solutions for energy management and security, setting new standards in hotel technology.

- Middle East and Africa: Hotels in the Middle East and Africa are making substantial investments in technology to meet the needs of tech-savvy travelers. Dubai, in particular, stands out as a center for technological innovation in hospitality, with hotels offering the latest state-of-the-art amenities and services to enhance the guest experience.

- Latin America: In Latin America, hotels are progressively adopting technology to improve guest experiences. Innovations like mobile check-ins, digital room keys, and online concierge services are becoming increasingly common, especially in major cities such as Mexico City and São Paulo, reflecting a growing trend towards tech-enhanced hospitality.

10. Experiential Travel Drives New Demand

Experiential travel, which focuses on offering authentic, in-depth experiences rather than simple sightseeing, is transforming demand in the hospitality sector.

More and more travelers are seeking unique and immersive experiences, leading hotels to innovate with a variety of carefully selected activities, incorporating elements of local culture and offering highly personalized services.

These strategies are designed to appeal to guests who crave more than just a stay, seeking memorable experiences that enrich their trip.

Regional Analysis: Experiential Travel Trends by Continent

- North America: Hotels in North America are embracing the experiential travel trend by offering distinctive activities such as guided city tours, culinary experiences, and adventure sports. Cities like New York and San Francisco are particularly popular due to their diverse cultural offerings and vibrant local scenes.

- Europe: Europe is a prime destination for experiential travel, with hotels offering tailored experiences that emphasize local heritage and culture. Destinations like Italy and Spain stand out for their immersive culinary tours, historical excursions, and art-focused stays, providing travelers with rich, culturally immersive experiences.

- Asia-Pacific: In the Asia-Pacific region, there is a growing demand for experiential travel, with hotels providing activities such as wellness retreats, participation in cultural festivals, and nature exploration. Countries like Thailand and Indonesia are highly sought after for their rich cultural experiences and stunning natural landscapes.

- Middle East and Africa: Hotels in the Middle East and Africa are concentrating on luxury and adventure experiences, offering activities such as desert safaris, cultural tours, and wellness retreats. The UAE and South Africa are leading the way, attracting travelers with high-end experiential travel options that combine luxury with unique local experiences.

- Latin America: In Latin America, hotels are capitalizing on the region's rich cultural and natural diversity to draw in experiential travelers. Popular activities include eco-tours, participation in cultural festivals, and adventure sports. Countries like Peru and Costa Rica are notable for their extensive offerings that blend natural beauty with cultural richness.

Hotel Industry 2024 - 2025: Challenges and Areas for Improvement

As explained in our previous blog post about 2024-2025 hotel industry trends and forecasts, the hospitality sector faces a mix of challenges and opportunities as it continues to recover from the pandemic.

Staffing shortages remain a critical issue, with many former employees having moved to other industries, making it difficult for hotels to maintain service quality and efficiency until at least 2025. To attract and retain talent, hotels are offering better wages, benefits, and career development opportunities, while also navigating the complexities introduced by increased automation and experience-based roles.

Another major challenge is overcoming persistant problems with online bookings, asking for IT infrastructure upgrades to prevent errors and ensure smoother operations.

Investment opportunities abound, especially in emerging markets like South Asia and Latin America, driven by growing middle-class populations and supportive economic conditions.

Technological innovation and sustainable practices also offer significant potential for growth, with AI and green technologies enhancing guest satisfaction and operational efficiency.

Changing customer habits, driven by technological advancements, have heightened expectations for personalized and immediate guest experiences, alongside a growing preference for local, sustainable tourism.

What Should Hotel Companies Do?

To remain competitive, hotel chains must now invest in data management and develop a data-driven decision culture. In short, hotel companies must leverage technology to stay competitive.

Failing to embrace the emerging trends mentioned in this article could result in missed opportunities for hotel chains.

Comprehensive and hotel-tailored BI solutions such as Hotel Management Dashboards offer a powerful and flexible monitoring platform tailored specifically for the hotel industry.

Hotel Management Dashboards is a customized and adaptable solution that provides a real-time complete monitoring platform for all operational areas across one or multiple hotels, allowing managers to visualize and understand their performance metrics more effectively.

The platform includes a Smart Revenue Management system that uses artificial intelligence to dynamically adjust prices and anticipate market trends, optimizing profitability and boosting revenue per available room (RevPAR).

In short, Hotel Management Dashboards provides hotel managers with the information they need whenever they needed.

Conclusion

In conclusion, the hotel industry is undergoing significant changes, driven by trends such as sustainable practices, technological advancements, and experiential travel. Regions across the globe are embracing these trends to offer unique experiences to guests and enhance operational efficiency.

To stay competitive, hotel companies must invest in data management and embrace emerging technologies to meet the evolving expectations of travelers.

As the industry continues to evolve, there are abundant opportunities for growth and innovation, especially in areas like emerging markets and sustainable tourism.

By staying informed and adapting to these trends, hotel chains can position themselves for success in the ever-changing landscape of the hospitality sector.

Hotel Industry Insights by Continents

Discover the trends that will shape the international hotel industry in the coming years.