What is the state of hotel chains in 2023? Discover the 10 most relevant stats from the latest report on the Spanish hotel sector in 2023.

After overcoming one of the sector's worst periods, Spanish hotel chains are currently in full recovery, even exceeding the 2019 numbers in certain indicators. This has now been confirmed by the new report on the Spanish hotel sector in 2023, which we explore through 10 insights.

The tourism and hospitality sector has experienced one of the most difficult periods ever due to the global pandemic caused by Covid-19, which has resulted in millions of dollars in losses for the sector worldwide.

According to UN figures, the global tourism industry has suffered a loss of 4 billion dollars in the last two years.

However, according to figures from McKinsey, 2022 was the first year of recovery for the global hotel sector.

On a national level, the Spanish hotel sector has always stood out for its dynamism and resilience, so the recovery is also advancing at the same pace as the global trend. However, it should be borne in mind that the restraint of the last two years may mean that hotel chains are not prepared to face the new challenges and trends in a society that is advancing very quickly and that is no longer the same after Covid-19:

The state of the Spanish hotel sector in 2023

A new Alimarket report confirms that 2022 has indeed been the year in which the Spanish hotel sector has started to rebound, even surpassing 2019 standards in certain areas.

Below, we review the 10 most important statistics included in the report, which you can also download for a more detailed and visual version:

10 insights about the Spanish hotel sector in 2023

1. Both national and international tourism are increasing

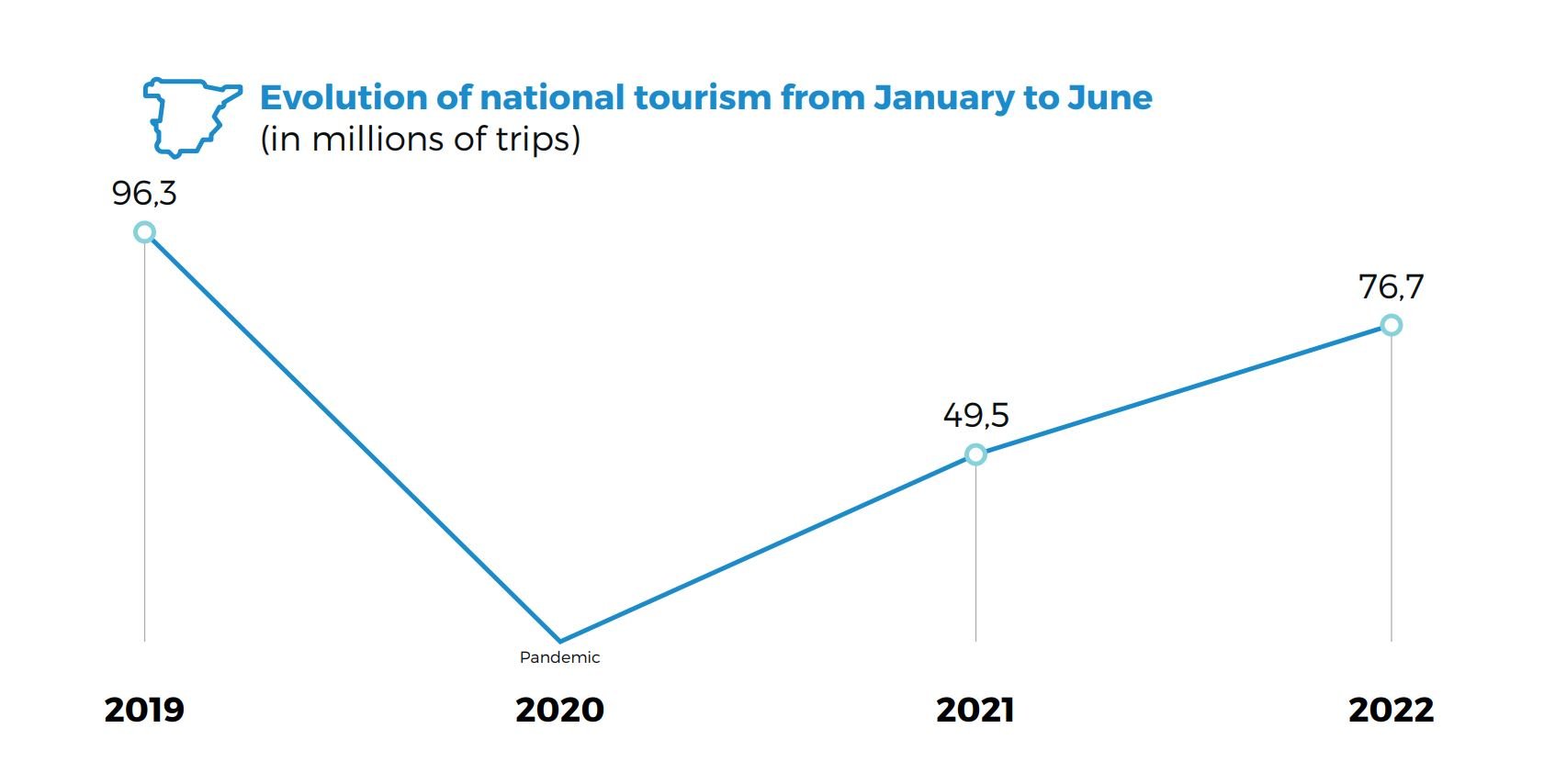

In 2021, tourism in Spain began to pick up. In fact, 2021 was the first year after the pandemic in which national tourism showed a growth trend. However, international tourism was slower to recover.

In 2022, however, both national and international tourism have grown at a good pace, even while accommodation prices have risen:

- In May 2022 — at the start of tourism season— the Consumer Price Index (CPI) for accommodation increased by 50.5% compared to the previous year.

2. Tourists and guests already spend about the same as before the pandemic

In the first six months of 2022, Spanish tourists and guests spent €18,702.4 M, a year-on-year increase of 144% and 94.7% of the figure for the same period in 2019.

Foreign visitors spent €76,433 M in the first ten months of 2022, a year-on-year increase of 176.9% and representing 93.4% of the expenditure recorded in the same period three years earlier.

This confirms that guests and tourists are now spending almost as much as they did before the pandemic.

3. The market share of Spanish hotel chains now exceeds 72%

If there is one thing that confirms the recovery of the Spanish hotel sector, it is the growth in market share, which has not stopped increasing every year since 2020.

In 2023, the market share of hotel groups in Spain is already on the verge of reaching 73%.

4. Tourism GDP exceeds pre-pandemic levels

During the third quarter of 2022, tourism GDP exceeded pre-pandemic levels for the first time since 2019, growing by 2.7% in one year.

On the other hand, according to figures from the Hotel Sector Barometer, operating revenues are also on the rise and already exceed 2019 figures in some indicators such as Average Daily Rate (ADR) and Revenue per Available Room (RevPAR).

However, the increase in operating revenues has not translated into an increase in profits for the country's hotel companies due to inflation over the last year.

5. Occupancy increases by more than 70%

In 2022, Spanish hotels achieved an occupancy rate of 68.3%, representing a growth of 70.8% compared to 2021. However, the average occupancy rate still falls short of the 2019 rate, which was around 76%.

6. Spanish accommodation stock grows by almost 2% in one year

The recovery is also noticeable in terms of the Spanish accommodation stock, which has grown by 1.7% in the last year.

Specifically, in 2023, the 591 hotel chains that make up the Spanish market (both national and international) already have more than 4,584 establishments and 600,159 rooms.

7. Ownership and rental remain a majority, but hotel chains are moving towards franchising and light management formulas.

The hotel chains in Spain are characterised by a significant ownership and rental nature. Specifically, in 2023, 83.96% of the establishments are owned or rented.

However, if we compare the numbers of recent years, we can see that there is an increasing trend towards the growth of light management formulas and franchises, which will already account for 16.04% of the accommodation units in 2023.

In the case of larger hotel chains, this tendency is even higher, given that these options are clearly more used by larger and more professional business structures, as well as by companies of an international nature. The top 10 hotel companies in Spain have 63.3% of their accommodation units in ownership and rental, while 36.7% are franchised or under light management formulas. International groups such as Hyatt, Marriott, Accor and IHG stand out in particular, with 89.7%, 94.5%, 97.3% and 100%, respectively, of their rooms being owned and rented under light formulas.

With regard to Spanish companies, the undisputed leader in the national market, Meliá Hotels International, has made a firm commitment since the pandemic to asset light assets. Of its 27 new openings during the first nine months of the year, all of them were managed or franchised, having created the 'Meliá Collection' soft brand to accommodate these formulas to a large extent. Similarly, between January and October 2022, the chain signed 28 projects, all of them in management and/or franchise models.

On the other hand, other major operators in Spain, such as Best Hotels, H10, Globales, Hipotels, Grupotel, Paradores, Allsun and Princess, stand out for their commitment solely to rental or ownership models.

8. More accommodations are moving towards luxury

Another significant trend that has emerged over the past year is the evolution of accommodation categories towards premium amenities and services. Guests have started to pay more attention to their customer experience in favour of holistic and high-end experiences.

Thus, new consumer demands are resulting in hotel chains offering higher quality rooms, services and experiences.

9. Openings continue to grow

Undoubtedly, 2021 surprised by the sheer number of openings in one year, with a total of 163 openings. The explosion of openings in 2021 can be explained by the number of openings planned for 2020, which had to be delayed by one year due to the pandemic.

In 2022 there were 114 openings, a slightly lower number than in 2021, but continuing the growth trend. These 114 new accommodations meant the addition of 8,141 rooms to the Spanish accommodation park.

In terms of destinations, the Spanish province with the highest number of openings in 2022 was Madrid, with 18 new accommodations and 1,933 rooms. On the other hand, the Hyatt group led the way with the opening of the 'Dreams Calviá Mallorca' (4E-391); the first hotel in Spain and in Europe of this luxury hotel brand.

10. New operators and experience-based brands

Finally, the arrival of new operators in the Spanish hotel market demonstrates, once again, the rise of hotels whose value is the offer of a holistic experience that goes beyond hospitality such as 'UMusic Hotels', 'Beaumier' or the new brand 'Zel'.

The chain 'UMusic Hotels', a joint venture between music company Universal Music Group and investor Dakia U-Ventures, has chosen Madrid as the location for the opening of the "UMusic Hotel Madrid", which is part of a company that creates immersive and experiential hotels inspired by music.

On the other hand, the French hotel chain 'Beaumier', has acquired the hotel "Petunia" in Sant Josep de Sa Talaia (Ibiza), marking its entry into the Spanish market. Beaumier now has a total of 9 establishments, eight of which are located in different parts of France, preferably in natural areas.

Meliá Hotels Group, a leading national hotel chain, has announced its new brand "Zel" in partnership with tennis player Rafael Nadal. The brand will focus on an experiential lifestyle, with a 4 Star Upper category, and aims to have 20 establishments worldwide in the next 5 years.

Conclusion

In this publication we have reviewed the 10 most relevant data from the latest report on the state of the Spanish hotel sector 2023. However, you can get a more detailed version by downloading the complete report: